Loading

Get Fatca Declaration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fatca Declaration Form online

Completing the Fatca Declaration Form online is an essential process for individuals who engage in financial transactions that may affect their tax residency status. This guide will walk you through each section of the form, ensuring that you provide accurate and complete information.

Follow the steps to successfully fill out the Fatca Declaration Form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

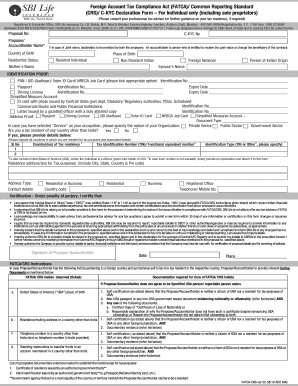

- Enter your Proposal No and C-KYC No. These identifiers are crucial for processing your form accurately.

- Provide the Proposer/Accountholder Name. If it's a joint account, ensure both names are included in the declaration manually.

- Fill in the Country of Birth and Place of Birth. This information helps clarify your tax residency status.

- Select your Residential Status by choosing one of the options: Resident Individual, Non Resident Indian, Foreign National, or Person of Indian Origin.

- Complete the fields for Mother's Name and Spouse’s Name if applicable.

- Provide your Identification Proof by selecting one of the listed options (PAN, UID, Voter ID, etc.) and enter the corresponding Identification Number along with the necessary expiry dates.

- If applicable, fill in the Simplified Measure Account information, including any relevant identification numbers.

- Specify your employment sector by selecting from Private Sector, Public Sector, or Government Sector. If you have selected 'Service' as your occupation, provide details about your organization.

- Indicate if you are a tax resident of any country other than India by selecting Yes or No. If Yes, provide details of all countries where you hold tax residency.

- Input your Residence Address(es) for Tax purposes, ensuring you include city, state, country, and pin code.

- Provide your Contact Details including the Telephone or Mobile Number.

- Read and agree to the certification statement. Confirming the accuracy of your information and your understanding of the implications.

- Sign the form by entering your name and date, along with the place.

- Once all information is correctly filled out, you can save changes, download the completed form, print it, or share it according to your needs.

Start completing your Fatca Declaration Form online today to ensure compliance and accuracy.

FATCA is used to locate U.S. citizens (residing in the U.S. or not) and "U.S. persons for tax purposes" and to collect and store information including total asset value and Social Security number. The law is used to detect assets, rather than income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.