Loading

Get Bare Trust

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bare Trust online

Filling out a Bare Trust can seem daunting, but with proper guidance, you can complete the process with confidence. This comprehensive guide will walk you through each section of the Bare Trust form to assist you in filling it out accurately.

Follow the steps to complete the Bare Trust form online.

- Click ‘Get Form’ button to obtain the Bare Trust form and open it in your preferred editor.

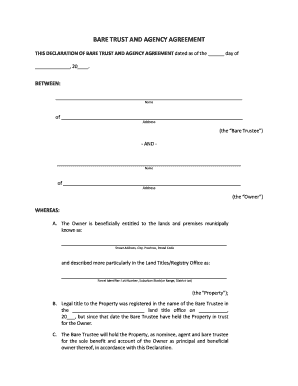

- In the first section, enter the date of the agreement in the format of day, month, year. This ensures that the document has a clear execution date.

- Provide the name and address of the Bare Trustee in the designated fields. Make sure to use the full legal name and the current address for accurate documentation.

- Next, enter the name and address of the Owner. Similar to the previous step, use the full legal name and current address of the Owner.

- In the WHEREAS section, you will need to describe the Property. Fill in the street address, city, province, and postal code properly, as well as the specific details required for the Land Titles/Registry Office.

- Proceed to the main body of the agreement where you will confirm the appointment of the Bare Trustee. Ensure that the Owner's acceptance of the Trustee's role is clearly stated.

- In the Bare Trustee’s Agreements section, make sure the terms regarding the Trustee's powers and obligations are clearly filled out. Pay attention to the responsibilities and rights of the Bare Trustee.

- Complete the Reimbursement of Expenses section. If the Bare Trustee incurs expenses, ensure that the Owner agrees to cover these costs.

- Fill in any additional sections regarding indemnity, notices, assurances, and governing law according to the specific circumstances surrounding the property and agreement.

- Finally, ensure that both parties sign the document at the end. The signatures must be accompanied by witness details to validate the agreement.

- Once all sections are completed, you can save changes, download a copy for your records, print the document, or share it as required.

Complete your Bare Trust document online for a seamless process.

An absolute trust, or bare trust as they are also known, is an arrangement whereby a settlor gives trustees cash or other assets to look after for a named beneficiary (or beneficiaries). The main difference from other types of trust is that the beneficiary(ies) cannot be changed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.