Loading

Get Request To Remove Unauthorized Credit Inquiry - Equifax - Hard Inquiry Removal Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the REQUEST TO REMOVE UNAUTHORIZED CREDIT INQUIRY - EQUIFAX - Hard Inquiry Removal Template online

This guide provides user-friendly instructions for completing the Request to Remove Unauthorized Credit Inquiry form for Equifax. It aims to assist users in submitting their requests effectively and ensuring that unauthorized credit inquiries are addressed promptly.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to retrieve the form and open it for editing.

- Enter the date on which you are filling out the form at the top, ensuring it is current.

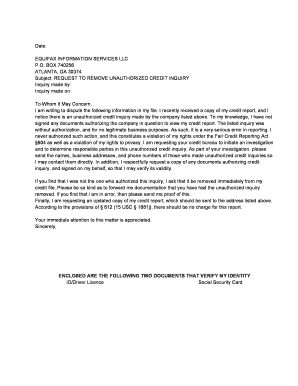

- Fill in the Equifax Information Services LLC address as follows: P.O. Box 740256, Atlanta, GA 30374. This ensures that your request is directed to the correct department.

- In the 'Inquiry made by' section, write the name of the company that performed the unauthorized inquiry.

- In the 'Inquiry made on' section, provide the specific date when this unauthorized inquiry occurred.

- Begin your letter with 'To Whom It May Concern' and state your purpose clearly. Mention that you are disputing an unauthorized credit inquiry based on your recent credit report examination.

- Provide a brief explanation that you have not authorized the company in question to access your credit report and express how this constitutes a violation of your rights.

- Request the credit bureau to initiate an investigation by explicitly asking them to find the responsible parties behind the unauthorized inquiry.

- Ask for the contact information of the parties involved in the unauthorized inquiry, as well as copies of any documents that purportedly authorized the inquiry.

- Politely request that if the inquiry is deemed unauthorized, it be removed from your credit file. Ask for confirmation once this has been completed.

- Request an updated copy of your credit report to be sent to your provided address at no charge, as per applicable regulations.

- Conclude your letter with 'Sincerely,' followed by your name. Finally, attach copies of the identity verification documents you are including.

- Review all the information you have entered for accuracy before proceeding to save your changes, download, print, or share the completed form as needed.

Complete your documents online to streamline your hard inquiry removal process.

Related links form

WalletHub, Financial Company No. Your credit score does not go up when a hard inquiry drops off your credit report. Your score will not go down when a hard inquiry drops off, either.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.