Loading

Get Tc69c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc69c online

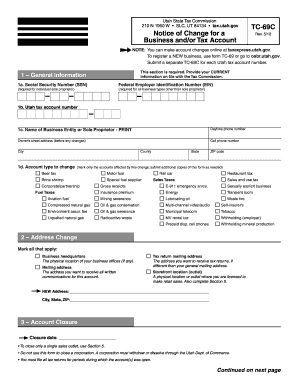

Filling out the Tc69c form is essential for managing changes to your business and tax accounts with the Utah State Tax Commission. This guide will walk you through each section of the form, ensuring you provide the necessary information accurately and efficiently.

Follow the steps to complete your Tc69c form online.

- Press the ‘Get Form’ button to access the Tc69c form and open it in your preferred document editor.

- Begin by entering your general information in Section 1. You need to provide your Social Security Number (SSN) if you are an individual sole proprietor, or your Federal Employer Identification Number (EIN) if you are representing a different business type. Fill in your Utah tax account number and the name of your business entity or sole proprietor, ensuring it is clearly printed. Include your daytime phone number, the owner's street address prior to any changes, and your cell phone number along with the city, county, and ZIP code.

- Select the account type(s) you wish to change in Section 1d. Mark only the accounts that are affected by this change. If you need to change multiple accounts, submit additional copies of this form.

- Proceed to Section 2 for any address changes. Mark all applicable addresses, including business headquarters and mailing addresses. Enter the new address details, including city, state, and ZIP code.

- In Section 3, if you are closing an account, provide the closure date. Note that this form is not for closing a corporation; you must complete that process through the Utah Department of Commerce.

- Complete Section 4 for any other account changes. You may add new phone numbers, change or add your email address, or update your DBA/business name. Be sure to attach any necessary documents if indicated.

- In Section 5, you can report changes to existing outlets. If you need to close sales tax, transient room, or tobacco outlets, mark the appropriate box and provide the closure date along with the outlet number.

- Finally, in Section 6, sign and date the form. It is important to note that your form will be rejected without a signature.

- After reviewing all entered information for accuracy, you can save your changes, download, print, or share the Tc69c form as required.

Start filling out your Tc69c form online today to ensure your business and tax details are up to date.

One of the best ways to protect your intellectual property is to register a trademark for your brand name, logo, designs, slogans, and any words associated with your brand. Obtaining a registered trademark for your brand's IP will allow you to use the registered trademark symbol "®" in conjunction with these assets.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.