Loading

Get Vat Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat Return Form online

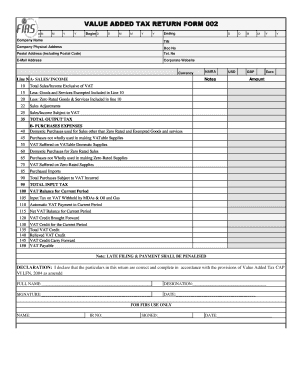

Filling out the Vat Return Form online is a straightforward process that allows users to report their Value Added Tax efficiently. This guide provides clear, step-by-step instructions on each section of the form, ensuring that you complete it accurately.

Follow the steps to complete the Vat Return Form successfully.

- Click ‘Get Form’ button to obtain the Vat Return Form and open it in your preferred online editor.

- Begin by entering the reporting period in the section marked 'Beginning' and 'Ending' dates. Ensure this reflects the correct month for your reporting.

- Provide your company name, Tax Identification Number (TIN), physical address, postal address (including postal code), telephone number, email address, and corporate website in the designated fields.

- In section A for Sales/Income, enter your total sales/income exclusive of VAT on line 10. This should include all sales from various sources.

- On line 15, enter the total amount of goods and services that are exempted, which are included in line 10.

- For zero-rated goods and services included in line 10, enter the total on line 20.

- If there are any sales adjustments that need to be reported, enter the total on line 22. This may include adjustments for omitted sales from previous periods.

- Calculate sales/income subject to VAT by subtracting the amounts on lines 15, 20, and 22 from line 10, and enter this result on line 25.

- To calculate total output tax, multiply the amount on line 25 by the VAT rate of 5% and enter it on line 35.

- In section B for Purchases Expenses, enter domestic purchases used for sales that are neither zero-rated nor exempted on line 40.

- Enter total purchases that are not wholly used in making VAT-able supplies on line 45.

- Calculate VAT suffered on VAT-able domestic supplies by adding lines 40 and 45, multiplying by 5%, and enter on line 55.

- For domestic purchases for zero-rated sales, enter the total amount on line 60.

- On line 65, enter purchases not wholly used in making zero-rated supplies.

- Calculate the VAT suffered on zero-rated supplies by adding lines 60 and 65, multiplying by 5%, and entering the result on line 75.

- For purchased imports, enter the VAT paid on chargeable goods on line 85.

- Determine total purchases subject to VAT incurred by subtracting line 45 from line 40 and adding line 85, then enter on line 90.

- Calculate the total input tax by multiplying the amount on line 90 by the VAT rate of 5% and enter on line 95.

- On line 100, enter the difference between total output tax (line 35) and total input tax (line 95).

- For lines 105 to 150, follow the instructions for input tax on withheld VAT, automatic VAT payment, and calculate your net VAT balance for the current period. Make sure to follow each line’s calculations as instructed.

- Finally, review all entries for accuracy, save any changes made, and you can download, print, or share the form as needed.

Complete your Vat Return Form online today and ensure your tax obligations are met efficiently.

VAT returns can only be submitted to HMRC online. The best online accounting services (such as Crunch!) make this process incredibly easy, leaving behind the days of VAT returns being a painful struggle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.