Loading

Get New Employee Registry Benefit Audit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Employee Registry Benefit Audit online

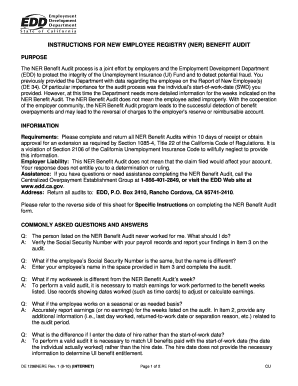

Completing the New Employee Registry Benefit Audit is essential for maintaining the integrity of the Unemployment Insurance Fund. This guide will provide you with step-by-step instructions to accurately fill out the audit online, ensuring compliance with the Employment Development Department's requirements.

Follow the steps to successfully complete the audit form.

- Press the ‘Get Form’ button to obtain the audit form and open it for completion.

- Review the form carefully. Begin by confirming that you have accurate records of the employee’s actual start-of-work date and ensure it aligns with the information previously submitted.

- In the section for the start-of-work date (SWD), enter the correct date if the previously provided one is inaccurate. If there is relevant additional information related to the audit period, provide it in the appropriate section.

- Verify the Social Security Number and the employee’s name against your payroll records. Report any discrepancies in the designated area, including the employee’s date of birth.

- Indicate the pay period interval, such as weekly or bi-weekly, and provide the corresponding hourly rate or salary amount.

- For each week reported in the audit, circle the days worked and indicate the types of earnings. Calculate the total hours worked and gross earnings for each week, ensuring the figures reflect the weeks when the work was performed.

- Sign the form in the provided space, stating your title, date, and fax number. Ensure that the telephone number is updated correctly.

- Once all sections are complete, you can save the changes, download the form, print it, or share it as needed to ensure its timely submission.

Complete the New Employee Registry Benefit Audit online today to ensure compliance and avoid potential penalties.

If you work or earn any wages while receiving Unemployment Insurance (UI) benefits, you must report these wages when you certify for benefits. You can certify with UI OnlineSM or by mail using the paper Continued Claim Form (DE 4581) (PDF).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.