Loading

Get Co Dora Tangible Net Benefit Disclosure 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DORA Tangible Net Benefit Disclosure online

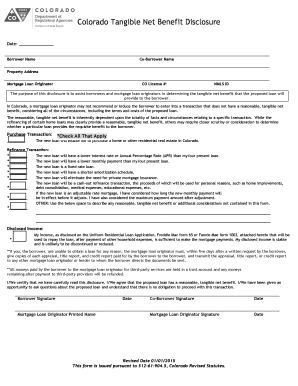

The CO DORA Tangible Net Benefit Disclosure is an important document that helps borrowers and mortgage loan originators understand the tangible net benefits of a proposed loan. This guide will provide clear instructions on how to fill out this disclosure online, ensuring you have all necessary information to complete the process accurately.

Follow the steps to complete the CO DORA Tangible Net Benefit Disclosure online.

- Use the ‘Get Form’ button to obtain the CO DORA Tangible Net Benefit Disclosure form and open it in the editing interface.

- Enter the date at the top of the form.

- Fill in your name as the borrower and, if applicable, the co-borrower's name.

- Provide the property address for the loan.

- Enter the mortgage loan originator's name, their Colorado license number, and their NMLS ID.

- Review the purpose section of the disclosure to understand how it supports the assessment of tangible net benefits.

- Indicate whether you are pursuing a purchase or refinance transaction by checking the appropriate box.

- If refinancing, check the applicable benefits that the new loan will provide (e.g., lower interest rate, lower monthly payment, etc.). If there are any other benefits not listed, describe them in the provided space.

- Disclose your income in the designated section, ensuring that it indicates your ability to make mortgage payments after other expenses.

- Read the certification statement carefully, confirming your understanding and agreement with the proposed loan's benefits.

- Sign and date the form, as well as having the co-borrower and mortgage loan originator sign and date where indicated.

- Once completed, you can save your changes, download, print, or share the form as needed.

Complete your CO DORA Tangible Net Benefit Disclosure online today for a smoother mortgage process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Net Tangible Benefit 5% Payment Reduction FHA defines a net tangible benefit as the mortgage payment dropping by at least 5%. The reduction must factor in principal, interest, and mortgage insurance. For example, a borrower currently has a 30 year fixed note rate at say 5% on a $200,000 loan.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.