Loading

Get Form 96 1112

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 96 1112 online

This guide provides clear and concise instructions on how to fill out the Form 96 1112 online. Whether you are familiar with legal documents or new to the process, this comprehensive guide will help you navigate each section with ease.

Follow the steps to complete Form 96 1112 online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering your personal information in the designated fields. This typically includes your name, address, and contact details. Make sure all information is accurate and up to date.

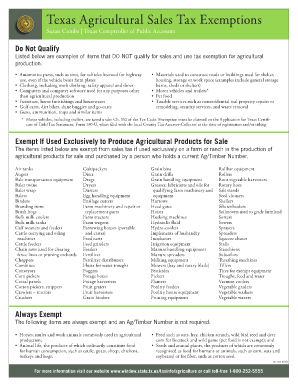

- Proceed to the section that outlines your eligibility for exemption. Indicate whether you hold a current Ag/Timber Number, as this will determine your qualifications for sales tax exemption.

- Next, review the list of items that qualify and do not qualify for exemption. Check the applicable boxes or provide the necessary details about the agricultural products you produce.

- If applicable, document any specific items you wish to list in the exemption request. Be detailed in this section to avoid any issues during processing.

- Once you have completed all sections, review the form thoroughly for any missing information or errors. Accuracy is crucial.

- Finally, save your changes, and download, print, or share the completed form as required.

Complete your Form 96 1112 online today to ensure your agricultural purchases are accurately reported.

Related links form

An exemption certificate must be in substantially the form of a Texas Sales and Use Tax Exemption Certification, Form 01-339 (Back). Copies of the form may be obtained from the Comptroller of Public Accounts, Tax Policy Division or by calling 1-800-252-5555.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.