Loading

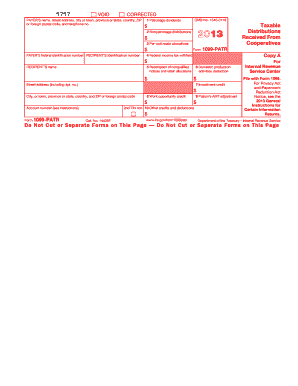

Get 1099 Replacement From Social Security For Year 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Replacement From Social Security For Year 2013 Form online

Filling out the 1099 Replacement From Social Security Form for the year 2013 can seem daunting, but with the right steps, you can complete it confidently online. This guide will walk you through each section of the form, ensuring you have all the necessary information to fill it out accurately.

Follow the steps to fill out the form effectively.

- Click the ‘Get Form’ button to access the form. This will open the document in an online editor where you can begin filling it out.

- Enter the payer's information in the designated fields. Include the payer's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number.

- Fill in the payer's federal identification number and the recipient's identification number accurately. These are essential for processing the form correctly.

- Proceed to the income sections. For each applicable box (1-10), input the amounts corresponding to patronage dividends, nonpatronage distributions, per-unit retain allocations, and any federal income tax withheld that may apply.

- Ensure all information is accurate, paying attention to the details for each box. If there are deductions or credits applicable from boxes 6 to 10, fill those in according to the instructions provided with the form.

- Review the form for correctness. Make sure all fields are completed as necessary before finalizing your form.

- Once satisfied, you can save your changes, download the form, print it, or share it as needed.

Complete your forms online today to ensure timely and accurate filing!

Do I need to report my dependent's SSA-1099 on my return? No. Your child or other dependent would report their SSA-1099 on their own return, but only if they make enough income to be required to file (this is uncommon). If Social Security is your dependent's only income, they most likely don't need to file a return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.