Loading

Get De 35

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the De 35 online

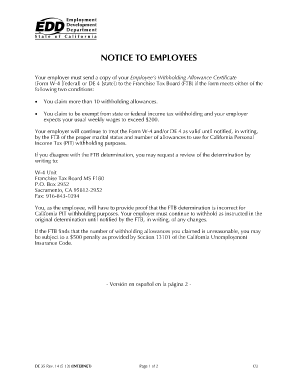

Filling out the De 35 is an essential step for employees regarding their withholding allowances. This guide offers a clear and supportive walkthrough to help you complete the form online efficiently.

Follow the steps to successfully fill out the De 35 form online.

- Click ‘Get Form’ button to access the De 35 document and open it in your editing tool.

- Begin by providing your full name at the top of the form. Ensure that the spelling matches the name on your identification documents.

- Next, indicate your Social Security number. This is crucial for identification and tax purposes; verify the number for accuracy.

- Fill out your address, including your city, state, and zip code. Double-check that all information is current and correct.

- In the section regarding withholding allowances, specify the number of allowances you are claiming. If you are claiming more than 10, be aware that your employer will need to notify the Franchise Tax Board.

- If applicable, confirm if you are claiming exemption from federal or state income tax withholding. Ensure you meet the necessary criteria for exemption.

- After reviewing all provided information for accuracy, finalize your form by providing your signature and the date.

- Once you have completed the form, decide whether to save the changes, download it, print a copy for your records, or share it with your employer.

Take control of your finances by completing the De 35 form online today.

You may reduce the amount of tax withheld from your wages by claiming one additional withholding allowance for each $1,000, or fraction of $1,000, by which you expect your estimated deductions for the year to exceed your allowable standard deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.