Loading

Get General Application For Rebate Of Gst/hst - Cra-arc Gc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the General Application for Rebate of GST/HST - CRA-ARC GC online

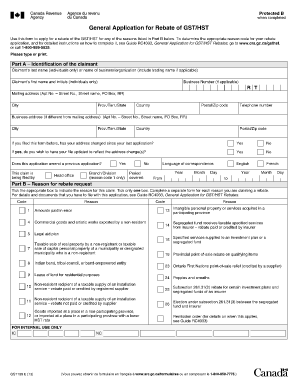

This guide provides a step-by-step approach to completing the General Application for Rebate of GST/HST online. Users can efficiently navigate through the form's sections and fields to ensure a correct and complete application.

Follow the steps to fill out the form accurately and efficiently.

- Press the ‘Get Form’ button to access the document and open it using the online editor.

- In Part A, enter the identification details of the claimant. If filing as an individual, input your last name and first name with initials. For organizations, include the name of the business along with the business number if applicable. Provide your mailing address, telephone number, and, if different, the business address.

- Indicate whether your address has changed since your last application and if you wish to update your file accordingly. Next, select your preferred language for correspondence.

- In Part B, select the reason for your rebate request by ticking the appropriate box. Remember to complete a separate form for each reason you claim.

- Proceed to Part C to calculate the rebate claimed. Fill in the amounts as prompted, ensuring to note which calculation method applies based on your reason for claiming.

- Complete Part D only if a third party is filing on your behalf. Ensure that the submitted Form GST507 matches the details provided in this part.

- In Part E, certify the truthfulness of your claims by providing your printed name and signature, along with the date.

- If necessary, complete Part F to list the details of the purchases associated with your rebate claim. Attach any required documents as indicated in the guidelines.

- For certain reason codes, complete Part G or Part H as applicable. Ensure that all third-party information, bank details, and authorizations are correctly filled.

- Save your changes, then download, print, or share the completed form as needed. Ensure proper submission based on your chosen mailing address for different reason codes.

Take the next step and complete your application online to receive your GST/HST rebate.

The maximum amounts for the 2019-2020 benefit year will increase from: $443 to $886 if you're single. $580 to $1,160 if you're married or living common-law. $153 to $306 for each child under the age of 19 (excluding the first eligible child of a single parent)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.