Loading

Get Char500 Nys 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Char500 Nys 2012 Form online

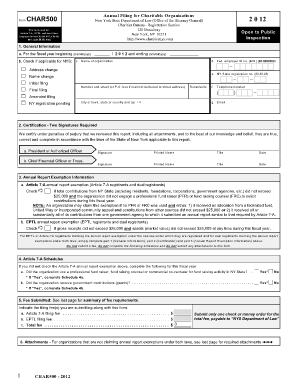

The Char500 Nys 2012 Form is a crucial document for charitable organizations operating in New York. This guide provides a comprehensive step-by-step approach to help you successfully navigate filling out the form online, ensuring that you meet all necessary requirements for submission.

Follow the steps to complete the Char500 Nys 2012 Form online.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen online platform.

- Begin by providing general information about your organization. Include the fiscal year start date and ensure to check the applicable boxes regarding changes, such as organization name or address changes, as well as initial or final filing status.

- Complete the certification section by obtaining two signatures. Both the President or Authorized Officer and the Chief Financial Officer or Treasurer must sign and print their names, titles, and dates.

- If applicable, indicate whether your organization qualifies for an annual report exemption. Answer the questions regarding total contributions and expenditure on fundraising activities accurately.

- If you are not exempt, proceed to the Article 7-A Schedules section. Answer questions about the use of professional fundraisers or government contributions and complete any required schedules.

- Determine the filing fee based on your organization's registration type and total support and revenue, and indicate the correct amount in the Fee Submitted section.

- If required, compile the necessary attachments, including IRS forms and any accountant’s reports. Make sure to include all listed documents in your submission.

- Finally, review all entries for accuracy. Save your changes, download a copy of the completed form, and print or share it as necessary to complete your submission.

Complete your Char500 Nys 2012 Form online today for timely submission!

If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day the return is late. The same penalty applies if the organization does not give all the information required on the return or does not give the correct information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.