Loading

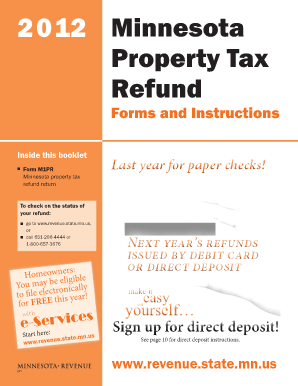

Get Minnesota Property Tax Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Minnesota Property Tax Return Form online

Filing the Minnesota Property Tax Return Form online can simplify the process of securing your tax refund. This guide provides thorough instructions on how to effectively complete the form, ensuring you captures all necessary information accurately.

Follow the steps to accurately complete your tax return online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by filling out the section for general applicant information. Enter your name and Social Security number. Ensure that these are correct as they are essential for processing.

- Indicate whether you are a renter or homeowner by marking the appropriate box at the top of the form. This determination will guide the rest of the form completion.

- If you are a renter, enter your total household income and provide the amount from all Certificates of Rent Paid (CRP) for the year. Ensure to check the income limits and determine eligibility based on provided tables.

- For homeowners, enter the property tax amount from the official Property Tax Statement. If applying for special refunds, include the required additional information such as the property ID and the county in which the property is located.

- Review and fill any required additional information, such as details concerning dependents or any other income if applicable.

- Check for errors by cross-referencing the input details with your previous federal tax returns. Ensure that all required fields are filled correctly to avoid delays in your refund.

- Finalize the process by signing the form electronically if required, or prepare the document for printing if submission must be via traditional mail.

- Once complete, save your changes, and download a copy for your records. Make sure to save both the filled-out form and any certificates you need to submit.

- Submit the form electronically, ensuring it is sent before the filing deadline to avoid penalties.

Start filling out your Minnesota Property Tax Return Form online now to secure your refund.

By Mail. You can call 1-800-TAX-FORM (800-829-3676) Monday through Friday 7:00 am to 10:00 pm local time except Alaska and Hawaii which follow Pacific time to order current year forms, instructions and publications as well as prior year forms and instructions by mail.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.