Loading

Get Rc1a Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rc1a Fillable online

Filling out the Rc1a Fillable form accurately is essential for opening a GST/HST account in Canada. This guide will provide you with clear, step-by-step instructions tailored to help users of all experience levels complete the form effectively.

Follow the steps to complete your Rc1a Fillable form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

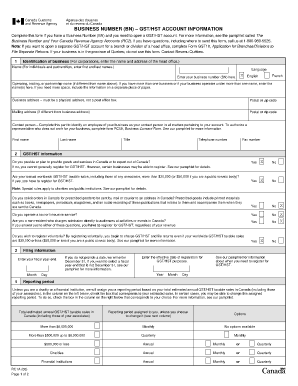

- Begin by completing the identification section of the form. If you are a corporation, enter the name and address of your head office. For individuals and partnerships, provide your first and last names. Clearly indicate your business number (BN) and enter your operating name if it differs from the above.

- Provide a physical business address, ensuring it is not a post office box. If you have a different mailing address, include that as well, and enter the relevant postal or zip code.

- Identify a contact person for your business by filling in their first name, last name, title, telephone number, and fax number. Remember, this should be an employee, and if you want to authorize a representative outside your company, use form RC59.

- Answer the GST/HST information questions clearly. Indicate whether you provide or plan to provide goods and services in Canada, and whether your annual taxable sales are above the indicated thresholds.

- Enter your fiscal year-end date. If you do not provide a date, it will default to December 31. Fill in the effective date of registration for GST/HST purposes.

- Specify your reporting period based on your total estimated annual GST/HST taxable sales and choose options if you want to change the assigned reporting period.

- Describe your major business activity in detail and specify up to two main products or services, including the estimated percentage of revenue each represents.

- If applicable, fill out the voluntary direct deposit routing information or attach a blank cheque. This step is important for faster refunds.

- Complete the certification section by signing and dating the form. Ensure that you provide your Social Insurance Number if necessary.

- Review all entries for accuracy before saving your changes. You can then download, print, or share the form as needed.

Complete your Rc1a Fillable form online today to ensure your GST/HST registration process goes smoothly.

How to create fillable PDF files: Open Acrobat: Click on the “Tools” tab and select “Prepare Form.” Select a file or scan a document: Acrobat will automatically analyze your document and add form fields. Add new form fields: Use the top toolbar and adjust the layout using tools in the right pane. Save your fillable PDF:

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.