Loading

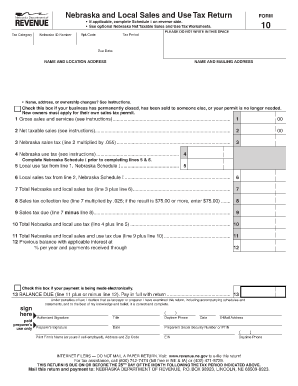

Get Nebraska And Local Sales And Use Tax Return, Form 10 - Revenue Ne

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska And Local Sales And Use Tax Return, Form 10 - Revenue Ne online

Filing the Nebraska and Local Sales and Use Tax Return, Form 10, can seem daunting, but with the right guidance, it becomes a manageable task. This guide offers clear, step-by-step instructions on filling out the form effectively online.

Follow the steps to complete your tax return with ease.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Fill in the Nebraska ID number and tax period in the appropriate fields. These are essential for identifying your tax report accurately.

- Enter your business name and location address. If your business has closed or ownership has changed, check the corresponding box.

- Complete the 'Gross sales and services' line by entering the total dollar amount of all sales, including taxable and exempt revenue.

- For 'Net taxable sales,' enter the amount after allowable deductions. Refer to the Nebraska Net Taxable Sales Worksheet if you need assistance.

- Calculate the Nebraska sales tax by multiplying your net taxable sales by the tax rate of 0.055, and enter this figure in the corresponding field.

- Complete the Nebraska use tax line, following any required instructions to report use taxes.

- If applicable, fill out your local sales and use tax amounts from Nebraska Schedule I.

- Calculate your total Nebraska and local sales tax, sales tax collection fee, and the final sales tax due, ensuring accuracy throughout.

- Confirm your balance due based on previous balances, interest, and payments received. Ensure completeness and correctness.

- Finalize the return by signing in the designated area, confirming accuracy and compliance. If applicable, include the paid preparer’s information.

- Review all entries for accuracy. Save changes, and choose to download, print, or share the completed form as needed.

Complete your Nebraska And Local Sales And Use Tax Return online today to ensure compliance and avoid penalties.

Almost Nobody Actually Pays It. Amazon doesn't charge sales tax in most states but you may still be on the hook to pay the tax. ... Forty-five states have a use tax. About 1.6 percent of the taxpayers in those 45 states actually pay the use tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.