Loading

Get Injured Spouse Ohio Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Injured Spouse Ohio Form online

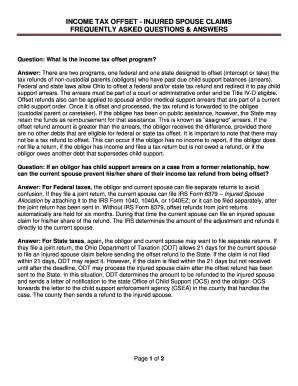

Filling out the Injured Spouse Ohio Form is an important step for individuals seeking to claim their portion of a tax refund that may be offset due to another person's child support obligations. This guide provides clear, step-by-step instructions on completing the form online, ensuring a smooth and efficient process.

Follow the steps to successfully complete the Injured Spouse Ohio Form.

- Click ‘Get Form’ button to obtain the Injured Spouse Ohio Form and open it in your preferred editor.

- Begin by entering your personal information in the designated fields. This includes your name, address, and Social Security number. Ensure that all entries are accurate to avoid delays.

- Next, provide the information of your partner, including their name and Social Security number. This section is essential for identifying the correct tax return to which the claim relates.

- Clarify your filing status for the tax year in question. Indicate whether you filed jointly or separately, as this can impact the processing of your claim.

- In the next section, detail the amount of the tax refund that is being claimed. Be specific about how much you believe is rightfully yours based on your income and deductions.

- Check the form for any additional requirements or fields that may need to be completed. Make sure you have included all necessary documents that support your claim.

- Review all entries for accuracy and completeness. Correct any mistakes before proceeding to the next step.

- Once completed, you have the option to save your changes, download a copy of the form, print it for your records, or share it as necessary for submission.

Start filling out the Injured Spouse Ohio Form online today to ensure you receive the rightful portion of your tax refund.

To file as an injured spouse, you'll need to complete Form 8379: Injured Spouse Claim and Allocation. If you're filing with H&R Block, you won't need to complete this form on your own. Just add our Tax Pro Review service and a tax pro will help you finish your return, including your Form 8379.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.