Loading

Get Form E 234 St Louis

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form E 234 St Louis online

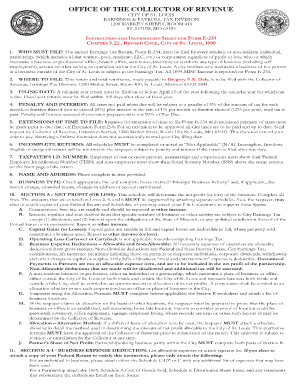

Filling out Form E 234 for St. Louis can be straightforward if you follow the outlined steps. This guide provides detailed instructions to help both residents and non-residents accurately complete the form online.

Follow the steps to fill out the Form E 234 St Louis online.

- Click ‘Get Form’ button to obtain the Form E 234 and open it in the editor.

- Ensure you have your taxpayer identification numbers ready. For individuals and partnerships, this is the Social Security Number (SSN) or Federal Employer Identification Number (FEIN). Provide the necessary information in the designated areas on the form.

- Fill in your name and address in the specified sections. Make sure that all information is accurate and current.

- Indicate your business type by checking the appropriate line and completing the boxes for 'Principal Business Activity' along with any required changes such as name or address updates.

- Complete Section A, which focuses on your net profit or loss. Ensure you input all relevant figures and provide attachments for lines that require additional documentation, such as separate schedules or a profit and loss statement.

- Navigate to Section A-1 and list your allowable business expense deductions. You may attach your Federal Return for further clarity if you choose.

- If applicable, proceed to Section A-2 to report specific deductions such as professional fees or commissions. Ensure proper documentation is provided to support your claims.

- Complete Section B if you are claiming business allocation for taxable net profits. Make sure to prepare any supporting documentation as required.

- In Section C, calculate your tax owed. Enter the necessary figures as instructed, including any penalties or credits that may apply.

- Before finalizing the document, ensure you have signed the form properly. If prepared by someone else, that individual must also sign.

- Review the entire form for completeness and accuracy before submitting. Save, download, or print your form as needed.

Encourage users to file their Form E 234 online promptly to ensure compliance and avoid late penalties.

Form E-234 is a business tax return to report and pay the earnings tax of 1% due. ... Not-For-Profit or Non-Profit businesses are exempt from filing and paying taxes after a photocopy of the Certificate issued by the Federal or State government has been filed with the Office of the Collector of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.