Loading

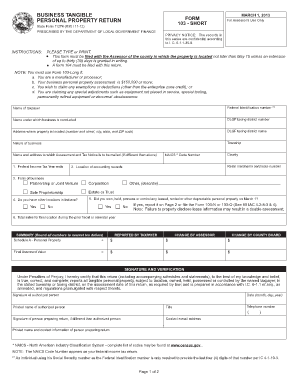

Get State Form 11274r30 11 12

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Form 11274r30 11 12 online

Filling out the State Form 11274r30 11 12, the personal property return form, can seem complex. However, with clear guidance, you can complete it efficiently and accurately online, ensuring that your documentation meets the required standards.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name as the taxpayer, along with your Federal Identification number. This information is crucial for identifying your business and verifying your assessment status.

- Provide the name under which your business is conducted, and include the DLGF taxing district number and the address where the property is located, ensuring to use the full detail required, including city, state, and ZIP code.

- List the nature of your business and specify the township where your property is located.

- Indicate the name and address where assessment and tax notices should be sent if different from the above entry.

- Complete the fields for the federal income tax year ends and the NAICS code number, which is essential for categorizing your business industry.

- State the location of your accounting records, and select the form of business from the options provided, such as partnership or corporation.

- Answer whether you have other locations within Indiana and detail accordingly.

- Indicate whether you owned, held, or controlled any leased or rented depreciable personal property on March 1. If yes, ensure to refer to the additional instructions for reporting.

- Fill in the total sales for your location during the prior fiscal or calendar year and calculate the final assessed value by rounding numbers appropriately.

- Review the signature and verification section at the bottom, confirming the return is accurate. Ensure to include the signature, printed name, title, date, and contact information.

- Finalize your form by saving changes, and consider downloading or printing it for your records.

Complete your documents online today to ensure timely filing and compliance.

Tax Warrant for Collection of Tax. If your account reaches the warrant stage, you must pay the total amount due or accept the expense and consequences of the warrant. Although this is not a warrant for your arrest, the information will appear on a credit report or title search and becomes a lien on your property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.