Loading

Get Form 571 L

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 571 L online

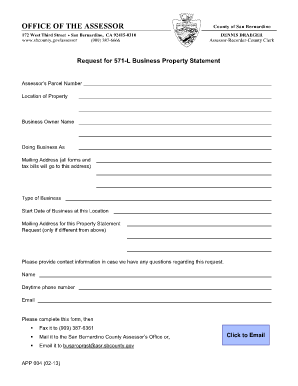

Filling out the Form 571 L is an essential step for business owners seeking to declare their business property to the San Bernardino County Assessor’s Office. This guide provides a clear, step-by-step approach to help you complete the form accurately online.

Follow the steps to complete the Form 571 L online successfully.

- Press the ‘Get Form’ button to access the Form 571 L, allowing you to fill it out online.

- Begin by entering the Assessor’s Parcel Number, which identifies the property in question.

- Fill in the location of the property where your business operates.

- Provide your business owner name as it appears in official records.

- If applicable, indicate your Doing Business As (DBA) name—this is the name under which your business operates.

- Enter your complete mailing address, where all forms and tax bills will be sent.

- Select the type of business you operate from the available options.

- Specify the start date of your business at the current location.

- If your mailing address for the property statement is different, enter the alternative address here.

- Include your contact information to assist the Assessor’s Office with any inquiries—provide your name, daytime phone number, and email address.

- Once you have completed all required fields, review the form for accuracy. You can then save your changes, download, or print the form, and share it for submission.

Complete your Form 571 L online today for a seamless filing experience.

You may apply for a Homeowners' Exemption if you do not have this type of exemption on any other property. The Assessor will automatically send exemption applications to new homeowners. Call (714) 834-3821 for more information. Homeowners' Exemption applications are not available on-line.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.