Loading

Get Form T778

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form T778 online

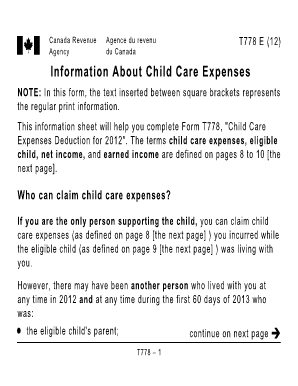

Filling out Form T778, which pertains to child care expenses, can seem daunting at first. This guide will provide you with clear and concise steps to ensure you accurately complete the form online.

Follow the steps to successfully complete Form T778.

- Press the ‘Get Form’ button to access the form online and open it in your preferred document editor.

- Begin by reviewing the definitions and important information provided in the accompanying information sheet to understand key terms such as 'eligible child' and 'child care expenses'.

- In Part A, list the first and last names as well as the dates of birth for all eligible children, along with the associated child care expenses paid.

- Proceed to Part B and calculate your basic limit for child care expenses based on the number of eligible children you are claiming for.

- If applicable, fill in Part C if you are the person with the higher net income, providing details of the other individual’s income and situation as per specified criteria.

- Complete Part D if you or another person was enrolled in an educational program during the year. Fill out the relevant lines based on your circumstances.

- Review all entered information for accuracy before finalizing your form.

- Once you have filled out all necessary sections, save any changes made, and proceed to download, print, or share the final document as needed.

Start filling out your Form T778 online to ensure you claim your child care expenses correctly.

Is this claimable on my tax return? Child care expenses are not claimable as a tax deduction. Eligible taxpayers may be able to claim the Child Care Tax Rebate (CCTR) through the Family Assistance Office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.