Loading

Get Tc 62m

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 62m online

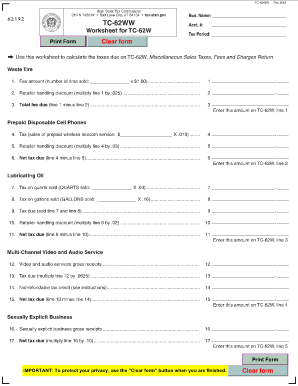

The Tc 62m form is essential for calculating and reporting miscellaneous sales taxes, fees, and charges in Utah. This guide will provide clear, step-by-step instructions to help users easily complete the form online.

Follow the steps to successfully fill out the Tc 62m form.

- Press the ‘Get Form’ button to acquire the Tc 62m form and open it in your editor of choice.

- Begin by entering your business name, account number, and the tax period in the designated sections of the form.

- Calculate the fee amount for waste tires by entering the number of tires sold and multiplying it by $1.00. Record this amount.

- Proceed to prepaid disposable cell phones. Enter your sales amount and calculate the tax by multiplying it by .019. Then, compute the retailer handling discount by multiplying the tax due by .03.

- For lubricating oil, enter the number of quarts sold and multiply by .04 to find the tax on quarts. Do the same for gallons sold, multiplying by .16. Add both to get the total tax due.

- For multi-channel video and audio service, enter your gross receipts and calculate the tax by multiplying by .0625. If applicable, subtract any nonrefundable tax credit from this amount.

- Finally, for sexually explicit business, enter the gross receipts and multiply by .10 to obtain the net tax due.

- Review all entered information for accuracy. Once satisfied, you can save changes, download a copy, print, or share the Tc 62m form.

Complete your Tc 62m form online today for a hassle-free filing experience.

Nevada does not have an individual income tax. Nevada does not have a corporate income tax but does levy a gross receipts tax. Nevada has a 6.85 percent state sales tax rate, a max local sales tax rate of 1.53 percent, and an average combined state and local sales tax rate of 8.23 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.