Loading

Get Fs Form 5396

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fs Form 5396 online

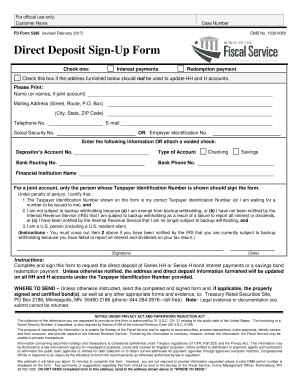

The Fs Form 5396 is a direct deposit sign-up form used to request the direct deposit of Series HH or Series H bond interest payments or a savings bond redemption payment. This guide offers clear instructions to help you complete the form online with confidence.

Follow the steps to complete the Fs Form 5396 online.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- Indicate whether you are requesting interest payments or redemption payments by checking the appropriate box.

- If you do not want the address provided in the form to update your HH and H accounts, check the designated box.

- Fill in your name or names (for joint accounts) in the 'Name' field.

- Provide your mailing address, including street, city, state, and ZIP code.

- Enter your telephone number and email address, or if applicable, your employer identification number or Social Security number.

- Fill in your bank account details including the depositor’s account number, account type (checking or savings), bank routing number, and bank phone number.

- Indicate the financial institution’s name. For joint accounts, only the person whose Taxpayer Identification Number is provided should sign the form.

- Review the declaration under penalty of perjury regarding your Taxpayer Identification Number, backup withholding, and U.S. person status, making any necessary adjustments.

- Sign and date the form. Ensure you follow the instructions carefully regarding the certification.

- Submit the completed and signed form to the Treasury Retail Securities Site as instructed, taking note that legal evidence or documentation submitted cannot be returned.

- Finally, save your changes, download, print, or share the form as needed.

Complete your Fs Form 5396 online today for seamless direct deposit processing.

Go into your TreasuryDirect account and set up a Payroll Savings Plan. Here, you'll decide what type and dollar value of savings bonds you want to purchase. Ask your employer to send the amount you choose to TreasuryDirect every time you get paid. This is just like sending your pay to a bank by direct deposit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.