Loading

Get - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS online

Filling out the IRS form can seem daunting, but with the right guidance, you can navigate the process with ease. This guide provides step-by-step instructions to help you confidently fill out your IRS form online.

Follow the steps to complete your IRS form accurately.

- Click ‘Get Form’ button to access the necessary form and open it in the editor.

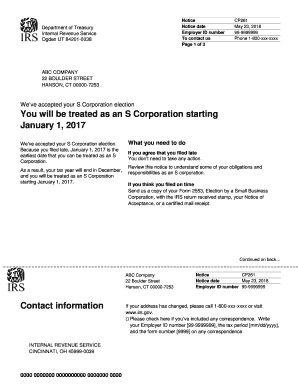

- Review the notice you received, ensuring you understand your S Corporation status and any obligations that come with it.

- If you agree that your filing was late, you do not need to take any action beyond understanding your responsibilities as an S Corporation.

- If you believe you filed on time, gather necessary documents, including your Form 2553 and any receipts or notices related to your filing.

- To prove timely filing, include a copy of your Form 2553 with the IRS return received stamp or the certified mail receipt.

- If you did not file on time and wish to seek relief, refer to Revenue Procedure 2013-30. Prepare the required documentation for your application.

- Complete Form 2553, ensuring all required signatures from shareholders are obtained, and include a statement explaining why you missed the filing deadline.

- Compile statements from shareholders confirming they have reported income consistent with the S Corporation election.

- If you determine that relief cannot be granted, consider applying for a Private Letter Ruling (PLR) for further resolution.

- After filling out the form, review all the information for accuracy before saving your changes, downloading, or printing the completed form for submission.

Start filling out your IRS documents online today for a straightforward filing experience.

If you get a phone call saying you won't receive government stimulus money unless you give the caller your personal information, IT IS A SCAM. Hang up the phone. In general, if you get any kind of suspicious phone call, don't give the caller any information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.