Loading

Get Promissory Note (loan Repayable In Installments Without Interest) - Maderacountylibrary

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Promissory Note (Loan Repayable In Installments Without Interest) - Maderacountylibrary online

This guide provides clear and concise instructions for completing the Promissory Note (Loan Repayable In Installments Without Interest) from Maderacountylibrary. Follow these steps to ensure you fill out the form correctly and meet all requirements.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the document online.

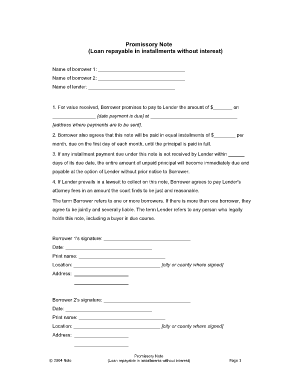

- In the first section, input the full name of borrower 1 in the designated field labeled 'Name of borrower 1'. If there is a second borrower, enter their name in 'Name of borrower 2'.

- Next, fill in the name of the lender in the field labeled 'Name of lender'. This identifies the individual or entity providing the loan.

- In the first clause of the note, specify the loan amount in dollars in the blank space provided. Then, enter the due date of the payment in the specified format in the next blank space.

- In the same clause, fill in the address where payments must be sent for the lender.

- For the repayment terms, state the amount to be paid in equal monthly installments in the appropriate blank space.

- Indicate the number of days allowed for late payments before the full loan amount becomes due by filling in the blank in the relevant clause.

- Both borrowers need to sign and date the document in the designated areas provided, ensuring each includes their printed name, the location where the document was signed, and their address.

- If required, include the Certificate of Acknowledgment of Notary Public at the end of the document to validate the signatures.

- After completing all fields, review the form for accuracy. You can then opt to save the changes, download, print, or share the document as needed.

Complete your documents online today for a seamless and efficient experience.

Some promissory notes require the payment of the full amount owed, plus interest, on a certain date. If the promissory note requires that periodic payments be made, such as quarterly, monthly, or even weekly, it is called an installment promissory note.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.