Loading

Get 2012 Form 3582

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form 3582 online

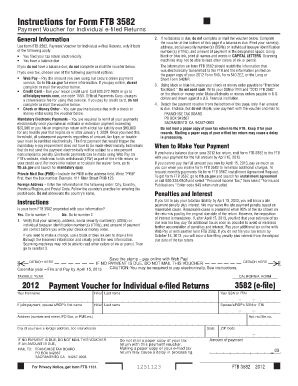

This guide provides a clear and supportive overview of how to complete the 2012 Form 3582, the payment voucher for individual e-filed returns. Follow the steps outlined below to ensure your form is filled out correctly and submitted online with ease.

Follow the steps to complete your 2012 Form 3582 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Check if the form FTB 3582 has your information preprinted. If yes, verify that your name(s), address, social security number(s) (SSNs) or individual taxpayer identification number(s) (ITINs), and amount of payment are accurate. If changes are needed, use a black or blue ink pen to mark corrections.

- If the form is not preprinted with your information, complete the designated sections by printing your name(s), address, SSNs or ITINs, and payment amount using black or blue ink in CAPITAL LETTERS to enhance readability for scanning devices.

- Next, make your payment by preparing a check or money order payable to 'Franchise Tax Board.' Include your SSN or ITIN and '2012 FTB 3582' on the payment. Ensure the payment amount is in U.S. dollars.

- Detach the payment voucher from the bottom of the form only if payment is due. Enclose your payment together with the voucher, making sure not to staple them together.

- Mail the completed voucher and payment to the address specified, ensuring you do not include a paper copy of your tax return, as this may delay processing.

- After completing the form and submitting your payment, remember to save any changes, download a copy, or share the form if necessary.

Complete your 2012 Form 3582 online today for a smooth submission process!

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.