Loading

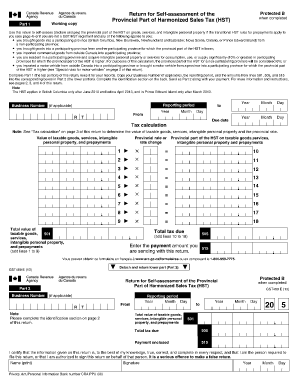

Get Rebate Fillable Application For Provincial Part Of Harmonized Sales Tax Hst Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rebate Fillable Application For Provincial Part Of Harmonized Sales Tax HST Form online

This guide provides users with clear and comprehensive instructions on completing the Rebate Fillable Application For Provincial Part Of Harmonized Sales Tax HST Form online. By following these steps, users can ensure that their application is filled out accurately and efficiently.

Follow the steps to effectively complete the application form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out Part 1 of the application. Enter your Business Number, if applicable, and the reporting period. Specify the month and year that the tax becomes payable. Ensure accurate documentation of dates.

- In the tax calculation section, determine the total value of taxable goods and services. Complete the chart by entering the value of each taxable item acquired.

- Proceed to calculate the provincial part of HST. Enter the applicable provincial rates depending on the province where the goods were brought.

- Sum the total tax due by adding the amounts calculated from the previous step. This will be displayed under 'Total tax due'.

- Pay attention to the payment section. Provide the payment amount you are sending along with this application.

- Complete Part 2 by copying relevant information from Part 1, ensuring accuracy in all fields.

- Finally, review the filled application, save your changes, and utilize the options to download, print, or share the form as required.

Complete your Rebate Fillable Application online today to ensure a smooth process!

File your GST/HST return (Form GST34) File certain schedules with your return. Allows filer to submit payment at the same time. Most financial institutions in Canada offer this service. Accessed from your financial institution's Internet banking (no CRA userid/password needed) Does not allow for filing of GST/HST rebates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.