Loading

Get Sc4972

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sc4972 online

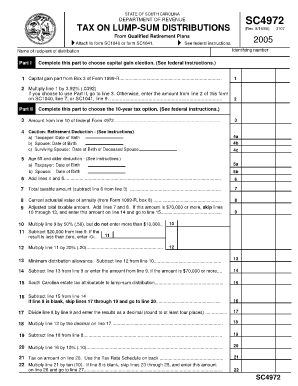

Filling out the Sc4972 form is essential for reporting tax on lump-sum distributions from qualified retirement plans in South Carolina. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Sc4972 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your identifying number in the designated field at the top of the form. This ensures accurate filing and connection to your tax records.

- Complete Part I to choose the capital gain election if applicable. Transfer the capital gain part from Box 3 of Form 1099-R to line 1. Then, calculate the amount for line 2 by multiplying line 1 by 3.92%. If you opt for Part II, proceed to line 3.

- For line 4, include the birth dates for the taxpayer and spouse, if applicable. This information is crucial for calculating any age-related deductions.

- Calculate line 6 by adding results from lines 4 and 5. This total will be subtracted from other figures as you progress through the form.

- Proceed to line 8 and input the current actuarial value of the annuity as per Form 1099-R, box 8. It’s essential this matches the documents you receive.

- If the total is less than $70,000, complete lines 10-13 to find the adjusted total taxable amount. Ensure to follow the calculations as outlined in the instruction for each specific line.

- Review all inputs for accuracy before proceeding to save changes, download, print, or share the completed form as needed.

Complete your Sc4972 form online today and ensure your tax submission is accurate and timely.

The cash lump sum (PCLS) and tax Any amount that you take as a PCLS is free of all taxes when it is paid to you. Members of defined contribution pension schemes have complete flexibility around how they can draw down their remaining pension pot after taking any PCLS, but these amounts withdrawn will be taxed as income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.