Loading

Get Form 458 Schedule 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 458 Schedule 1 online

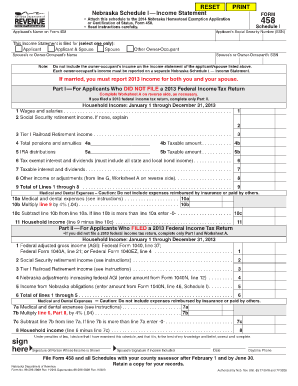

Filling out the Form 458 Schedule 1 is an essential step in the Nebraska Homestead Exemption application process. This guide will assist you in completing the form accurately and efficiently, ensuring you provide all necessary information.

Follow the steps to complete the Form 458 Schedule 1 online.

- Click the 'Get Form' button to acquire the Schedule 1 document and open it in your preferred online editor.

- Begin by entering the applicant’s name as it appears on Form 458 and their Social Security Number (SSN) in the designated fields.

- Indicate whether the income statement is being filed for the applicant, applicant and spouse, spouse, or other owner-occupant by selecting the appropriate option.

- If applicable, provide the name and SSN of the spouse or other owner-occupant in the respective fields, ensuring that each owner's income is reported on a separate Form 458 Schedule 1.

- For Part I applicants who did not file a 2013 Federal Income Tax Return, complete the necessary Worksheet A on the reverse side to calculate other income or adjustments.

- In Part I, fill in your household income details from January 1 through December 31, 2013, including wages, Social Security retirement income, rail retirement income, pensions, annuities, and other specified income sources.

- Carefully calculate and report any medical and dental expenses. Ensure these amounts comply with the provided instructions and do not include any reimbursed expenses.

- For Part II applicants who filed a 2013 Federal Income Tax Return, enter your Federal adjusted gross income (AGI) and other relevant income information as outlined on the form.

- Review all entered information for accuracy and completeness, and ensure all fields are filled as required by the instructions provided with the form.

- Finally, save any changes made to the form, and download or print a copy for your records. Ensure you submit the completed Form 458 and all attached schedules to your county assessor within the specified timeframe.

Take action now and complete your Form 458 Schedule 1 online to secure your Nebraska Homestead Exemption.

In Nebraska, a homestead exemption is available to the following groups of persons: • Persons over the age of 65; • Qualified disabled individuals; or • Qualified disabled veterans and their widow(er)s. Some categories are subject to household income limitations and residence valuation requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.