Loading

Get Pit Rc Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pit Rc Form online

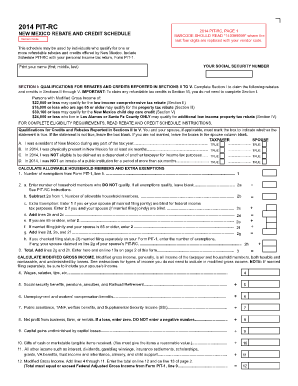

The Pit Rc Form is essential for residents of New Mexico to claim various tax rebates and credits. This guide provides a comprehensive overview of how to complete the form online, ensuring you understand each section to maximize your benefits.

Follow the steps to fill out the Pit Rc Form accurately and efficiently.

- Click ‘Get Form’ button to access the Pit Rc Form and open it in an online editor.

- Begin by filling out Section I, where you will qualify for various rebates and credits reported in subsequent sections. Ensure that you carefully answer all questions regarding your residency and status for 2014.

- Proceed to Section II to input any relevant low-income comprehensive tax rebate details. Be meticulous in providing accurate figures as they play a crucial role in determining eligibility.

- Move on to Section III, where you will need to calculate your total exemptions and assess your modified gross income. Follow the prompts closely to add any applicable income sources without including any negative values.

- In Sections IV and V, enter any additional tax credits related to child care and other relevant categories accurately, ensuring that the totals align with the income calculated previously.

- Complete Section VI, detailing any refundable tax credits, and finally Section VII, where you will add all the rebates and credits claimed, positioning the total on the designated line of Form PIT-1.

- After filling out all necessary sections, make sure to review your entries. Once satisfied, save the changes, download a copy, print for your records, or share the completed form as needed.

Start filling out the Pit Rc Form online today to maximize your tax benefits.

The State of New Mexico requires pass-through entities (which may be a state law partnership or a limited liability company taxed as a partnership) to withhold tax at 5.9% on earnings of non-resident partners or members if the owner's distributive share of net income is over $100 in a year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.