Loading

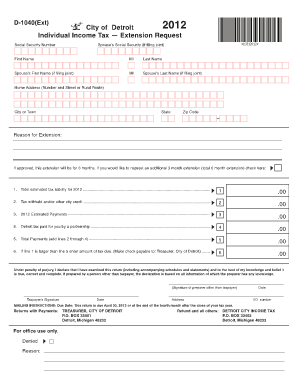

Get D 1040 Extension Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D 1040 Extension Form online

Filing for an extension can provide you with additional time to complete your tax return and ensure you are filing accurately. This guide will walk you through the process of filling out the D 1040 Extension Form online, highlighting each section and essential element.

Follow the steps to complete the D 1040 Extension Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Input your Social Security Number in the designated field. If you are filing jointly, also provide your partner's Social Security Number.

- Fill in your first name, middle initial (if applicable), and last name. If filing jointly, include your partner's first and last name in the respective fields.

- Enter your home address, including the street number and name or rural route, city or town, state, and zip code.

- Provide the reason for your extension request in the specified section.

- If you wish to request an additional three-month extension, indicate this preference by checking the appropriate box.

- Complete the estimated tax liability for the year in the line labeled 'Total estimated tax liability for 2012.'

- Enter the tax withheld and/or other city credit in the next designated line.

- Input the total of any estimated payments already made for the year on the next line.

- If applicable, include the amount of Detroit tax paid on your behalf by a partnership in the specified section.

- Add the amounts from lines 2 through 4 to determine the total payments, and enter this sum in the designated area.

- If your total estimated tax liability (line 1) is greater than the total payments (line 5), indicate the amount of tax due in the appropriate field.

- Read and affirm the declaration under penalty of perjury by signing the form. If someone else prepared your form, they must also sign it and provide their information.

- Finally, you can save your changes, download, print, or share the completed form as needed.

Start your process to file the D 1040 Extension Form online today.

A filing extension is an exemption that can be made to either individual taxpayers or businesses that are unable to file a tax return to the federal government by the due date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.