Loading

Get Ui23

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ui23 online

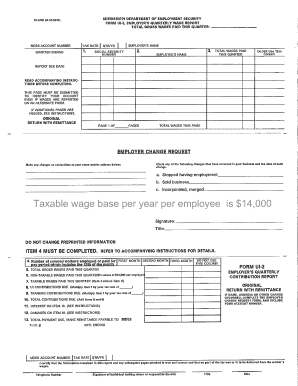

Filling out the Ui23 form online is a straightforward process that can simplify your reporting tasks. This guide provides step-by-step instructions to ensure you accurately complete the form and meet all requirements.

Follow the steps to successfully complete the Ui23 form.

- Click the ‘Get Form’ button to access the Ui23 form. This will open the document in an editable format, allowing you to enter the required information directly.

- Enter the employee’s Social Security Number in the first field. If an employee does not have an SSN, you may submit the report using their name until they receive their number.

- In the next field, input each employee’s name, including two initials followed by their full last name.

- Document the total gross wages paid to each employee for Mississippi employment in the appropriate section. This should encompass all cash payments as well as the cash value of any non-cash payment.

- If you require additional space for listing employees and wages, write down the extra information on a separate sheet of plain white paper and include it with Form Ui23. Ensure that the total wages from this additional sheet are included at the top of Form Ui23.

- Proceed to enter the total number of employees for the payroll period in the designated area, noting that this includes both full-time and part-time employees for each month of the calendar quarter.

- Fill in the total gross wages paid to employees, including both taxable and non-taxable wages, making sure this aligns with the total recorded in the previous step.

- Determine the non-taxable wages for each employee. Remember, the first $14,000 paid to each employee per calendar year is taxable, and any amount exceeding that is non-taxable.

- Calculate taxable wages by subtracting the non-taxable amount from the total gross wages.

- Multiply your taxable wages by your Unemployment Insurance (UI) Contribution Rate to find the total contributions due for this item.

- Calculate 1% monthly interest from the due date of the report until paid, based on the total contributions calculated in the previous step.

- Compute any damages owed for late contributions or filings, applying the proper percentages as specified.

- Total up the contributions, interest, and any damages calculated to find the final amount due. Make sure to review your entries carefully before finalizing.

- Once all fields are completed, save your changes. You may then choose to download, print, or share the completed form as necessary.

Start filling out your documents online to ensure compliance and ease of reporting.

No, you don't need to know how to code to be a UX/UI designer. You may have heard that user interface design requires programming, but nothing could be further from the truth. In fact, in most cases, what is happening is that design is being confused with programming.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.