Loading

Get How To Complete T3012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Complete T3012 online

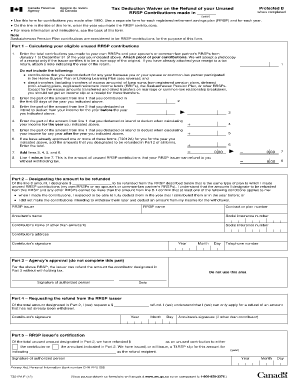

Filling out the How To Complete T3012 form is essential for users seeking a tax deduction waiver on their unused registered retirement savings plan (RRSP) contributions. This guide will walk you through each section of the form to ensure proper completion and submission.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Enter the year in the designated area at the top of the form where it states 'when completed'. Make sure this reflects the year you made your RRSP contributions.

- In Part 1, calculate your eligible unused RRSP contributions by entering the total contributions made to your own and your spouse's or common-law partner's RRSP from January 1 to December 31 of the selected year. Remember to attach proof of your contributions as specified.

- Report the portion of your contributions made in the first 60 days of the year in section 2 of Part 1.

- Indicate the part of the amount from line 1 that you have deducted or intend to deduct from your income for the prior year in section 3.

- For section 4, enter the part of the amount from line 1 that you propose to deduct when calculating your income for the current year.

- Note the part of the sum from line 1 that you will deduct for any year following the year indicated in line 5.

- If applicable, add any previously approved amounts from Part 2, section 6 and enter the total.

- Subtract line 7 from line 1 in section 8. This will result in your unused RRSP contributions available for refund without tax withholding.

- In Part 2, designate the amount of line 8 that you would like refunded by entering it in the designated space.

- Complete the RRSP issuer details, including their name, contract number, and your personal information as required.

- After filling out Part 3, return three copies to the tax agency for approval.

- Once approved, complete Part 4 and send the necessary copies to your plan issuer.

- Lastly, the RRSP issuer will certify the amount in Part 5 and return the remaining copies to you.

Start completing your documents online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.