Loading

Get Dr0204

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr0204 online

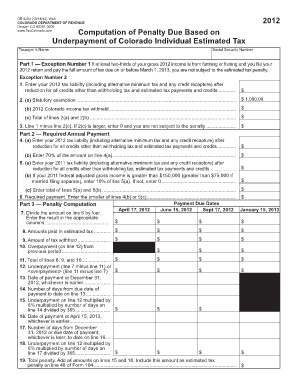

This guide provides clear and concise instructions for users on how to fill out the Dr0204 online form for computing the penalty due based on underpayment of Colorado individual estimated tax. Following these steps will help ensure accurate completion of the form.

Follow the steps to successfully complete the Dr0204 online.

- Click the ‘Get Form’ button to obtain the Dr0204 form and access it in the editor.

- Enter the taxpayer's name and Social Security Number in the designated fields at the top of the form. Ensure that the information is accurate and matches official documentation.

- Proceed to Part 1, where you will assess if you qualify for any exceptions to the estimated tax penalty. Complete Exception Number 1 and Exception Number 2 by entering the required tax liability and credit information.

- In Part 2, calculate your required annual payment by entering your 2012 tax liability, then compute 70% of that amount as well as your previous year's tax liability, if applicable. Enter these values in the respective fields.

- Complete Part 3 by calculating the penalty based on your underpayment. Follow the numbered lines to determine amounts due for each quarter and record the total penalty in the final field.

- If you earn income unevenly throughout the year, consider completing Part 4 to utilize the annualized installment method for estimating taxes, entering taxable income and applicable percentages in the required fields.

- Review all entered information carefully for accuracy. Once satisfied, you can save your changes, download the form, print it, or share it as necessary.

Complete your tax documents online today to ensure timely submission and compliance.

Colorado Cash Back Refunds On May 23, 2022, Gov. Jared Polis signed a new law (Senate Bill 22-233) to give Coloradans a tax rebate of $750 for individual filers and $1,500 for joint filers this summer. If you've already filed your Colorado state income tax return, you're all set!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.