Loading

Get T4013 Printable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T4013 Printable Form online

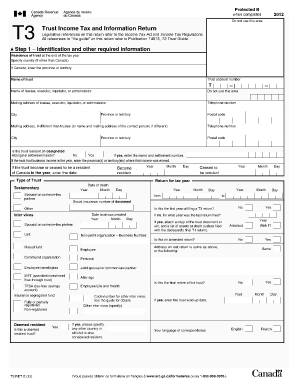

The T4013 Printable Form is used for reporting trust income and is essential for compliance with tax regulations. This guide provides comprehensive instructions on how to accurately complete the form online, ensuring that all necessary information is included for a successful filing.

Follow the steps to complete the T4013 Printable Form effectively.

- Click ‘Get Form’ button to access the T4013 Printable Form online and open it for editing.

- Begin by entering the required identification information in Step 1. Specify the residence of the trust, including the country and province or territory, along with the name and trust account number. Additionally, provide the trustee's mailing address and contact information. Ensure all fields are filled out accurately to prevent processing delays.

- In Step 2, focus on calculating the total income. Report various types of income such as taxable capital gains and rental income. Carefully follow the guidelines provided in the associated schedules to ensure all income is reported correctly.

- Proceed to Step 3 to calculate the net income. This includes deducting allowable expenses and adjustments to arrive at the net income figure for the trust. Make sure to review your entries and utilize any applicable instructions from the guide as you calculate.

- In Step 4, compute the taxable income by applying deductions. Enter total amounts and ensure that all relevant deductions are accounted for accurately.

- Lastly, proceed to Step 5 for the summary of tax and credits. Review the total taxes payable and any applicable credits to determine whether a refund or balance is owed. Before submitting, double-check all entries for accuracy,

Complete your T4013 Printable Form online for seamless processing and compliance.

Distributions From Trust Income When a portion of a beneficiary's distribution from a trust or the entirety of it originates from the trust's interest income, they generally will be required to pay income taxes on it, unless the trust has already paid the income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.