Loading

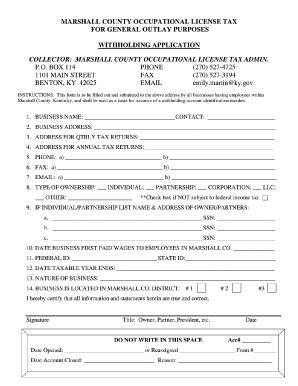

Get Marshall County Occupational License Tax For Schools Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Marshall County Occupational License Tax For Schools Form online

Filling out the Marshall County Occupational License Tax For Schools Form online can be a straightforward process when you have the right guidance. This guide provides you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory section of the form to understand the purpose and importance of the Occupational License Tax for Schools. It is essential to take note of any deadline related to the submission.

- Fill in your personal information in the designated fields. This typically includes your name, address, and contact information. Ensure accuracy to avoid any delays in processing.

- Provide your business information, including the business name, type of business entity, and corresponding identification numbers. Confirm that all information matches your business records.

- Include your annual gross receipts. This amount should reflect your business's total income, and you may need to reference your financial records to ensure accuracy.

- Calculate the tax owed based on the provided instructions on the form. Check the rates applicable to your type of business to ensure you are computing the correct amount.

- Review all filled sections for accuracy and completeness. It is important to ensure that no fields are left blank unless indicated as optional.

- Save your changes in the editor to keep a copy of your filled form. You should also consider downloading a version for your records.

- Print the form if necessary for submission. Alternatively, you may also be able to share it through available online options if provided.

Start completing your Marshall County Occupational License Tax For Schools Form online today!

Related links form

Marshall County Occupational License Fee for General Outlay 1. Withholding Tax - Any employer with employees working in Marshall County must withhold 1% of gross wages earned while working within Marshall County. These withholdings are remitted/reported quarterly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.