Loading

Get Schedule Nts L Nr Py 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule Nts L Nr Py 2018 online

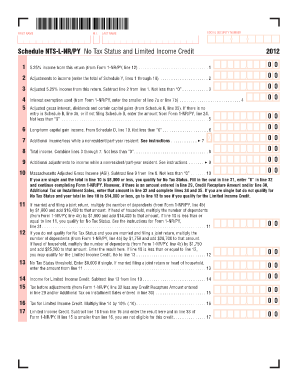

Filling out the Schedule Nts L Nr Py 2018 form online can seem challenging, but with a clear guide, the process becomes manageable. This document assists you in reporting your tax status and income credit accurately.

Follow the steps to complete the Schedule Nts L Nr Py 2018 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your first name, middle initial, and last name in the appropriate fields. Ensure that you provide accurate spellings as this information is vital for identification purposes.

- Input your social security number accurately in the designated section. This number is essential for tax processing and identification.

- Begin your financial entry by noting the 5.25% income from your return as reported on Form 1-NR/PY, line 12. Place this amount in line 1.

- For line 2, enter any adjustments to income which you may have calculated through Schedule Y, lines 1 through 10.

- Calculate your adjusted 5.25% income by subtracting line 2 from line 1, entering the result in line 3. Ensure this value is not less than zero.

- Continuing to line 4, input the interest exemption used as indicated from Form 1-NR/PY, entering the smaller of the values from line 7a or line 7b.

- Provide your adjusted gross interest, dividends, and certain capital gains on line 5, using data from Schedule B, line 35 or Form 1-NR/PY, line 24.

- In line 6, enter your long-term capital gain income derived from Schedule D, line 19, keeping it at a minimum of zero.

- For line 7, add any additional income or loss experienced as a nonresident or part-year resident and consult the instructions for accurate completion.

- Total your income by combining lines 3 through 7 and enter this in line 8, ensuring it is not less than zero.

- Document any additional adjustments to income while a nonresident/part-year resident in line 9 as provided in the instructions.

- Calculate your Massachusetts Adjusted Gross Income (AGI) by subtracting line 9 from line 8 and ensuring it is not less than zero in line 10.

- If you qualify for No Tax Status, follow the instructions closely for single and married filers provided within the form.

- Continue completing the necessary calculations for lines 11 through 17 as instructed, ensuring accurate computations.

- At the final step, review all filled information for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete your Schedule Nts L Nr Py 2018 form online for an efficient filing process.

Nonresidents. If you're a nonresident with an annual Massachusetts gross income of more than either $8,000 or the prorated personal exemption, whichever is less, you must file a Massachusetts tax return. You are an individual nonresident if you are neither a full-year or part-year resident.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.