Loading

Get Formulario 9465(sp) - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulario 9465(SP) - Internal Revenue Service - Irs online

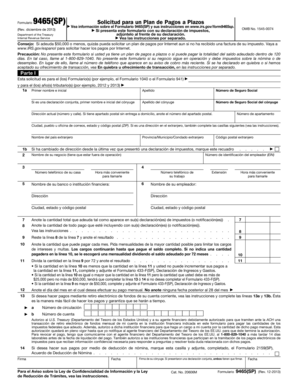

Filling out the Formulario 9465(SP) can be an essential step in managing your tax responsibilities. This guide offers clear, step-by-step instructions to ensure you complete the form accurately, making the process straightforward and accessible for all users.

Follow the steps to fill out the Formulario 9465(SP) effectively.

- Press the ‘Get Form’ button to access the Formulario 9465(SP) online and open it in your preferred editor.

- Begin by identifying the specific form(s) you are requesting a payment plan for, such as the Form 1040 or Form 941, and indicate the tax year(s) applicable.

- Enter your first name and middle initial in the designated fields, followed by your last name and Social Security number. If it is a joint application, also include your spouse's name and Social Security number.

- Provide your current address, including street number and name. If you have a P.O. Box, indicate that information. Fill in the apartment number if applicable, as well as your city, state, and ZIP code. If your address is international, complete any additional fields for foreign addresses.

- If you have recently changed your address, mark the appropriate box indicating this change.

- If your business is temporarily out of operation, enter the business name and Employer Identification Number (EIN) if applicable.

- Input your home phone number and the most convenient time to contact you.

- List your work phone number and your employer’s name and address.

- Calculate your total tax debt as specified in your tax return or notifications, and enter that amount.

- If you are submitting any payments along with your application, indicate that amount.

- Deduct the payment amount from your total tax liability and write the result.

- Indicate the monthly payment amount you can afford, aiming to make the highest possible payment to minimize interest and penalties. Note that if no amount is entered, the IRS will determine your payment plan.

- If applicable, indicate how you wish to make your monthly payments and provide the necessary banking details for electronic funds withdrawal.

- Sign and date the form. If this is a joint application with your spouse, they also need to sign.

- Complete any additional information required in Part II, if applicable, especially if you have defaulted on a previous payment plan.

- Review the completed form for accuracy. Once verified, you can save changes, download, print, or share the form as necessary.

Complete your Formulario 9465(SP) online with ease and ensure your tax obligations are managed effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Internal Revenue Service (IRS) allows taxpayers to pay off tax debt through an installment agreement. ... If paying the entire tax debt all at once is not possible, an installment agreement is an alternative allowed by the IRS.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.