Loading

Get Form Mt 903 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Mt 903 Instructions online

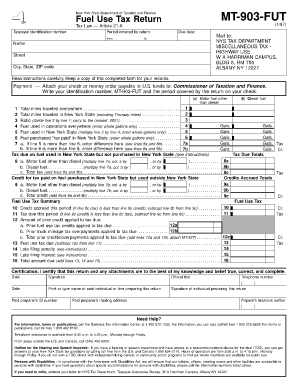

Filling out the Form MT-903-FUT for fuel use tax can seem complex, but this guide breaks it down into easy steps. By following these instructions, you can complete the form accurately and efficiently, ensuring compliance with New York State regulations.

Follow the steps to complete the Form MT-903-FUT online.

- Click 'Get Form' button to obtain the form and open it for editing.

- Enter the taxpayer identification number at the top of the form to identify your tax account.

- Input the period covered by the return using 'from' and 'to' fields, specifying the reporting timeframe.

- Fill in your name, street address, city, state, and ZIP code in the designated fields to enable contact from the tax department.

- Mailing address for submission should be confirmed as NYS Tax Department, Miscellaneous Tax Highway Use, W A Harriman Campus, BLDG 8, RM 706, Albany NY 12227.

- Review and complete each line carefully, starting with total miles traveled everywhere (Line 1) and total miles in New York State (Line 2). Ensure to use whole miles.

- Calculate the ratio of miles traveled in New York State to total miles and enter this on Line 3.

- Document the total gallons of fuel used in operations generally and in New York State on Lines 4 and 5, respectively.

- On Lines 6 through 7b, accurately record fuel purchased tax paid in New York State and compute any differences, entering 0 where applicable.

- Follow the instructions for tax calculations on Lines 8a, 8b, and 9a, 9b for any accrued tax or credit.

- Consolidate the tax information on Lines 10 through 16, ensuring to incorporate all previous credits and calculations for tax due.

- Sign and date the certification section at the bottom of the form, providing your official title and contact information.

- Once all fields are complete and verified, save your changes, and opt to download, print, or share the form as needed.

Be sure to complete your forms online to ensure a streamlined filing process.

When buying a car in New York, you will pay a 4% sales tax rate for your new vehicle, ing to Sales Tax States. This statewide tax does not include any county or city sales taxes that may also apply.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.