Loading

Get West Virginia Amended Income Tax Return - State Of West Virginia - State Wv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the West Virginia Amended Income Tax Return - State Of West Virginia - State Wv online

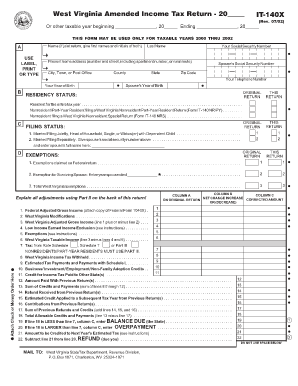

Completing the West Virginia Amended Income Tax Return (Form IT-140X) online is a straightforward process that allows users to correct any mistakes made on their original tax returns. This guide provides clear, step-by-step instructions tailored for all users, regardless of their previous experience with tax forms.

Follow the steps to accurately amend your income tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Section A: Type or print your name(s), address, and Social Security number(s) legibly in the spaces provided. Remember to include your year of birth and telephone number where you can be reached during the day.

- Section B: Indicate your residency status by selecting one option—either resident for the entire tax year, nonresident/part-year resident filing a separate return, or nonresident filing a special return.

- Section C: Choose your filing status by checking the appropriate box for either married filing jointly, head of household, single, or married filing separately. If applicable, enter your spouse's name and Social Security number.

- Section D: Fill out the number of exemptions claimed on your federal return. If you are claiming an exemption for a surviving spouse, enter the year of your spouse's death.

- Complete lines 1 through 22 of the form. Column A requires the amounts from your original return. Column B is where you note the net increase or decrease for each line being changed, while Column C reflects the new corrected amounts.

- Line 1: Enter your federal adjusted gross income. Line 2: Include any modifications to your income, referring to the appropriate schedules if necessary.

- Continue filling out the form by detailing any credits and payments from previous returns. Ensure all supportive documentation is attached as needed.

- Upon completing the form, review it for accuracy. Users can then save changes, download a copy for their records, print the form, or share it electronically as needed.

Start the process of filing your West Virginia Amended Income Tax Return online today!

The easiest and fastest way to request a filing extension is to electronically file an IRS Form 4868 through your tax professional, tax software, or using the Free File link on IRS.gov. Any extension automatically granted through the filing of that federal form will be extended to any West Virginia filer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.