Loading

Get Typable D400x Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Typable D400x Form online

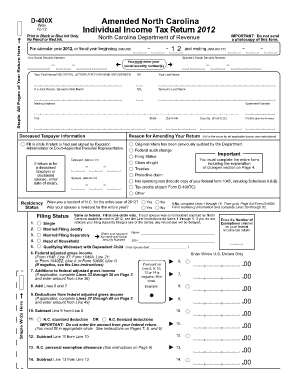

Completing the Typable D400x Form online is a crucial step in ensuring your amended tax return for North Carolina is submitted accurately. This guide provides you with step-by-step instructions to easily navigate the form and its components.

Follow the steps to efficiently fill out the Typable D400x Form online.

- Click ‘Get Form’ button to access the D400x Form and open it in the online editor.

- Begin by entering your Social Security Number in the designated field. Ensure accuracy as this information is vital for your tax records.

- Fill in your name in capital letters, including your first name, middle initial, and last name. If you are filing jointly, include your partner's name as well.

- Provide your mailing address, including apartment number, city, state, county, and zip code. This ensures that any correspondence from the tax department reaches you.

- Indicate the dates relevant to your tax status for 2012, including your and your partner's date of death if applicable.

- Select your filing status by filling in the corresponding circle. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

- Enter the number of exemptions claimed on your federal return in the provided section to ensure correct calculation of your taxable income.

- Complete sections regarding additions to and deductions from federal adjusted gross income, entering whole U.S. dollars only.

- For part-year residents or nonresidents, fill in your residency information accurately, including dates when residency began and ended if relevant.

- In the final section, securely save your changes, then download, print, or share the completed form as needed.

Ready to complete your documents online? Start filling out your Typable D400x Form now.

Form NC-5 is used to file and pay withholding tax on a monthly or quarterly basis, based on your filing frequency. Form NC-5 is filed throughout the year, before you file Form NC-3. ... Compare the tax you paid during the year to the amount shown on your employees and contractors W-2s and 1099s.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.