Loading

Get Ow 8 Esc 2015 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ow 8 Esc 2015 Form online

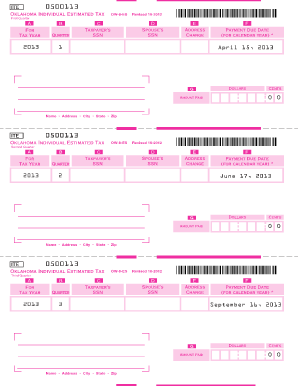

The Ow 8 Esc 2015 Form is essential for individuals in Oklahoma who need to file their estimated tax payments. This guide provides a straightforward approach to completing the form online, ensuring that users are well-informed about each section and requirement.

Follow the steps to complete the Ow 8 Esc 2015 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the tax year and the quarter number required for your payment. Make sure to select the correct year and quarterly period for your estimated tax payment.

- Input your Social Security Number in the designated field, ensuring accuracy to avoid delays in processing.

- If applicable, enter your spouse’s Social Security Number in the corresponding section for joint tax filings.

- Indicate any address change by marking the 'Address Change' box and providing your updated address information.

- Fill in the payment due date, noting that this is crucial for your payment schedule. If you do not follow a calendar year, adjust the date as necessary.

- Enter the amount due in both dollars and cents, being careful to double-check your calculations for accuracy.

- Review all inputted information for correctness before proceeding. Accurate completion can prevent issues with your estimated tax payments.

- Once completed, you can save changes, download, print, or share the form as needed for your records or submissions.

Take action now and complete your Ow 8 Esc 2015 Form online to ensure timely processing of your estimated tax payments.

Some states (for example Illinois and Wisconsin) have "reciprocity" agreements, under which a taxpayer who lives in one state and works in another pays income tax only to his/her home state, but OK and TX have no such agreement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.