Loading

Get Mo-1040a Calculating - Missouri Department Of Revenue - Dynamic Stlouis-mo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO-1040A Calculating - Missouri Department Of Revenue - Dynamic Stlouis-mo online

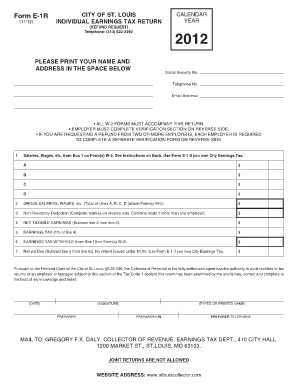

Filling out the MO-1040A Calculating form accurately is essential for non-residents seeking a refund on their earnings tax in the City of St. Louis. This guide provides clear, step-by-step instructions tailored for users at all experience levels.

Follow the steps to fill out your MO-1040A Calculating form online:

- Press the ‘Get Form’ button to access the MO-1040A form and open it for editing.

- Enter your full name and address in the designated space at the top of the form.

- Provide your Social Security number, telephone number, and email address in the corresponding fields.

- List all your earnings from the W-2 forms you have received for the tax year in the sections marked A, B, C, and D.

- Calculate the gross salaries by summing the amounts listed on lines A, B, C, and D, and enter the total on line 2.

- Complete the non-residency deduction calculation as instructed on the reverse side of the form, and write the result on line 3.

- Subtract the non-residency deduction (line 3) from your gross earnings (line 2) to determine your net taxable earnings, and record this figure on line 4.

- Calculate your earnings tax by taking 1% of the amount on line 4; enter this value on line 5.

- Enter the total earnings tax withheld as shown in box 19 of your W-2 forms on line 6.

- Compute your refund amount by subtracting line 5 from line 6, and indicate the result on line 7. Note that refunds under $1.00 will not be issued.

- Review all entered information for accuracy and clarity. It is important to ensure that all W-2 forms are attached.

- Sign and date the form at the bottom to certify that the information provided is accurate.

- Submit the completed MO-1040A form to the address listed for the Collector of Revenue by the due date.

Complete your MO-1040A Calculating form online to ensure a seamless filing process.

Your personal tax return is IRS Form 1040. A W-2 is a report by your employer (to you and to the IRS) of your wages which is to be attached to your personal return. So, yes, a W-2 is different from your personal tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.