Loading

Get Schedule Ct It Credit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule CT-IT Credit Form online

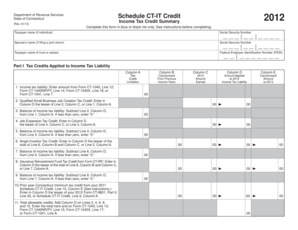

This guide provides clear, step-by-step instructions for filling out the Schedule CT-IT Credit Form online. It aims to support all users, regardless of their legal experience, in accurately completing their tax credit summary.

Follow the steps to complete the Schedule CT-IT Credit Form effectively.

- Press the ‘Get Form’ button to acquire the Schedule CT-IT Credit Form and open it for editing.

- Begin filling out the form by providing the taxpayer name and social security number in the designated fields. If filing a joint return, include the spouse's name and social security number as well.

- In Part I, record your income tax liability from the appropriate form lines in Column A. Ensure accuracy in reporting these figures to accurately determine your available tax credits.

- Complete each tax credit line by entering the corresponding amounts in Column C, indicating the amount earned, and in Column D, specifying the amount applied to your 2012 income tax liability. Use the instructions provided for each specific tax credit to fill out these colums accurately.

- Continue through the remaining lines, ensuring to subtract any applicable amounts as directed and verify that your total allowable credits are accurately summed in Column D, Line 11.

- In Part II, if applicable, enter the type of tax credit from the pass-through entity or trust, and fill in the corresponding federal employer identification number and amount of credit.

- Review your completed Schedule CT-IT Credit Form thoroughly for any errors or omissions.

- Finally, save your changes, and depending on your preference, download, print, or share the completed form as needed.

Complete your Schedule CT-IT Credit Form online today to ensure accurate processing of your tax credits.

Related links form

About Form CT-1, Employer's Annual Railroad Retirement Tax Return | Internal Revenue Service. An official website of the United States Government.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.