Loading

Get Ocwen Loss Fillable Mitigation Package Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ocwen Loss Fillable Mitigation Package Form online

Filling out the Ocwen Loss Fillable Mitigation Package Form online can be a straightforward process when approached step by step. This guide provides clear instructions to help you navigate the form efficiently and effectively.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the form and open it in your online editor.

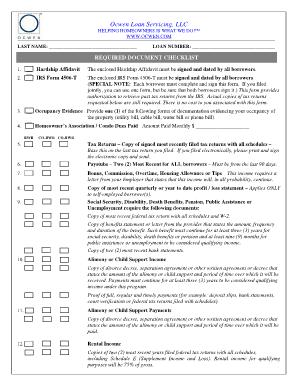

- Begin with the required document checklist section. Ensure you have all necessary documents on hand, such as the hardship affidavit and IRS Form 4506-T, and verify that each must be signed and dated by all borrowers.

- Complete the occupancy evidence section by providing one form of documentation that proves your occupancy of the property, such as a recent utility bill.

- Fill in information regarding homeowner’s association or condo dues, specifying the amount paid monthly.

- Gather and submit your tax returns for the most recent year. If you filed electronically, remember to print and sign the electronic copy.

- Provide pay stubs for the most recent two months for all borrowers to demonstrate current income.

- For additional income types like bonuses or tips, include a letter from your employer confirming the expected continuation of this income.

- If applicable, include a profit and loss statement if you are self-employed.

- Document social security or disability benefits with statements or letters that outline the amount, frequency, and duration.

- For alimony or child support income, include legal documents that specify the amount and duration, along with proof of regular payments.

- Submit rental income documentation by providing two years of filed federal tax returns, including supporting schedules.

- Fill out the hardship affidavit section, where you need to indicate specific financial challenges impacting your ability to make payments.

- Complete the government monitoring section, if you choose to provide personal information, or mark the option for not wishing to furnish this information.

- Read and acknowledge all statements in the affidavit, ensuring you understand the implications of providing false information.

- Finally, provide your contact information for follow-up and sign the form where indicated before saving or sharing your completed form.

Take action now: complete your Ocwen Loss Fillable Mitigation Package Form online to seek the assistance you need.

Appeal If Loan Modification Was Denied Federal law generally requires servicers to give homeowners 14 days to appeal a loan modification denial. In most cases, this appeal right kicks in if the servicer receives your loan application 90 days or more before the foreclosure sale date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.