Loading

Get Co Op Tax Abatement Primary Residence Verification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Co Op Tax Abatement Primary Residence Verification online

The Co Op Tax Abatement Primary Residence Verification is an essential document for property owners seeking property tax reductions through eligibility verification. This guide provides a step-by-step approach to successfully complete the form online, ensuring compliance with the necessary requirements.

Follow the steps to fill out the form accurately and efficiently.

- Click 'Get Form' button to obtain the form and open it in the editing interface.

- Begin by entering your personal information in the designated fields. This usually includes your full name, address, and contact details. Ensure that all information is accurate and up-to-date.

- Next, indicate your ownership status. If you are the owner of the unit, select the appropriate option that confirms your ownership, such as 'Owner' or 'Co-owner.' If applicable, provide the names of co-owners.

- Complete the primary residence section by confirming that the unit listed is indeed your primary residence. This is crucial for qualifying for the tax abatement. If there are multiple units, specify the unit being used as your primary residence.

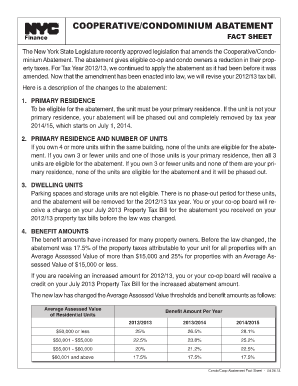

- Review any additional sections that pertain to the number of units owned. Be sure to note if you own three or fewer units and confirm if one of those is claimed as your primary residence.

- Check the eligibility criteria section to affirm your understanding of the requirements for the tax abatement. This may involve reviewing statements regarding the phase-out period for non-primary residences.

- Once all fields are completed, review your entries for accuracy. Ensure that no section has been left blank unless specifically instructed.

- Finally, save changes to your document. You may also download, print, or share the form as needed once you confirm that everything is completed correctly.

Complete the Co Op Tax Abatement Primary Residence Verification form online today to ensure you secure your eligible tax reductions.

An abatement is an assessment appeal process that occurs when, generally, there must be either an error in the physical data of your property or the assessment must not be proportional to other properties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.