Loading

Get Llet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Llet online

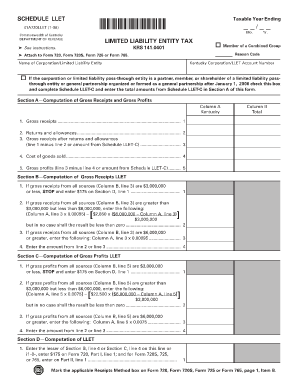

This guide provides step-by-step instructions for filling out the Limited Liability Entity Tax (Llet) form online. The Llet is essential for Taxable Year reporting in Kentucky, and understanding its components will ensure that users complete the form accurately.

Follow the steps to complete the Llet form effectively.

- Click 'Get Form' button to obtain the Llet form and open it for editing.

- In the section labeled 'Taxable Year Ending,' enter the relevant year for which the tax applies, formatted as month/year.

- Indicate whether your entity is a member of a combined group by checking the appropriate box and provide the reason code if applicable.

- In 'Section A—Computation of Gross Receipts and Gross Profits,' fill in the gross receipts before returns and allowances for Kentucky in Column A and for all sources in Column B.

- Enter any returns and allowances in the second line of Section A according to the same columns (A for Kentucky, B for Total). Calculate gross receipts after returns and allowances on the third line.

- Input the cost of goods sold in Column A and B, specifying any relevant amounts. Determine gross profits in the fifth line by calculating total gross receipts minus cost of goods sold.

- Complete Section B by calculating the Llet on Kentucky gross receipts based on the thresholds provided. Ensure to follow the guidance on which calculations to apply based on your gross receipts amount.

- Repeat the process in Section C for calculating Llet on gross profits, entering corresponding figures based on gross profits.

- In Section D, calculate the total Llet liability by entering the lesser amount from the previous sections or a set minimum amount as specified.

- Review all entries for accuracy. Finally, save changes, download, print, or share the completed form as needed.

Complete the Llet form online to ensure timely processing for your entity.

A corporation or limited liability pass-through entity granted an extension of time for filing a federal income tax return will be granted the same extension of time for filing a Kentucky income and LLET return for the same taxable year provided a copy of the federal Form 7004 is attached to the Kentucky income and ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.