Loading

Get Form Rd 3550 6

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form RD 3550 6 online

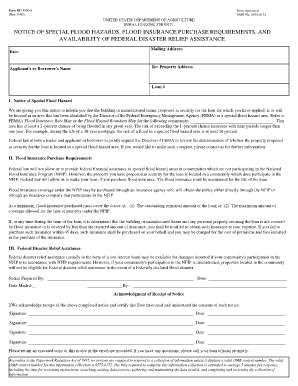

Filling out the Form RD 3550 6 is an essential step for applicants seeking financial assistance related to rural housing. This guide will walk you through the process in a clear and supportive manner, ensuring you understand each component of the form.

Follow the steps to successfully complete the Form RD 3550 6 online.

- Click the 'Get Form' button to obtain the form and open it in your preferred online editor.

- Enter the mailing address in the designated field. Make sure it is complete, including street number, street name, city, state, and ZIP code.

- Fill in the date of completion. Ensure that the date reflects when you are submitting the form.

- Provide the property address for which the loan is being sought. Include all necessary details to avoid confusion.

- Input the applicant's or borrower's name accurately. This should reflect the legal name of the person or entity applying.

- List the loan number if applicable. This field is essential for identifying the specific loan associated with your application.

- Review the section on the notice of special flood hazard carefully. Understand how it pertains to your property and ensure you acknowledge the information provided.

- Fill out the flood insurance purchase requirements. Acknowledge your understanding that flood insurance is necessary and indicate your intent to purchase it.

- Complete the federal disaster relief assistance section, ensuring you understand the implications of community participation in the National Flood Insurance Program.

- Sign and date the acknowledgment of receipt of notice section. This confirms that you have reviewed and understood the contents of the notice.

- Finally, save your changes, and decide whether to download, print, or share the completed form as needed.

Complete your Form RD 3550 6 online today for swift processing.

Flood insurance will be required if the home equity loan is secured by a building or mobile home located, or to be located, in an Special Flood Hazard Area (SFHA) in which flood insurance is available under the National Flood Insurance Act.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.