Loading

Get 1098 T Printed Online Cox College Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1098 T Printed Online Cox College Form online

The 1098 T Printed Online Cox College Form is an essential document for students, providing critical information regarding tuition and related expenses for tax purposes. This guide will walk you through the steps needed to accurately fill out this form online, ensuring you have all the necessary details at hand.

Follow the steps to complete your 1098 T Printed Online Cox College Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

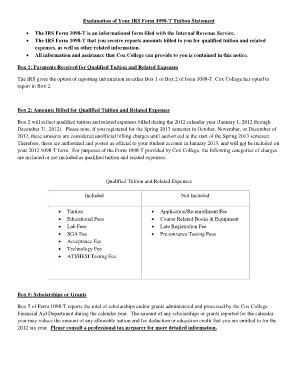

- Locate Box 2 on the form, which indicates the amounts billed for qualified tuition and related expenses, covering the calendar year. Ensure it accurately reflects the charges incurred during the specified time.

- Review the lists of qualified tuition and related expenses included in the form. These may consist of tuition, educational fees, lab fees, and other specified charges. Ensure that all relevant fees are correctly documented.

- Verify the amounts shown in Box 5, which reports the total scholarships or grants you received. This information is essential, as it may influence your tuition deductions and education credits.

- Carefully check all entries for accuracy, ensuring that all applicable fees and expenses are correctly listed and that scholarships or grants are accurately reported.

- Once all information is filled out and reviewed, you can save your changes, download the form, print it for your records, or share it as required.

Take the next step and complete your 1098 T Printed Online Cox College Form online today.

The amount of the credit is figured by calculating 20% of the first $10,000 of qualified education expenses up to that maximum of $2,000 per taxpayer. You can claim the $2,500 American Opportunity Credit for each qualifying student on your federal income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.