Loading

Get Ftb 1138

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 1138 online

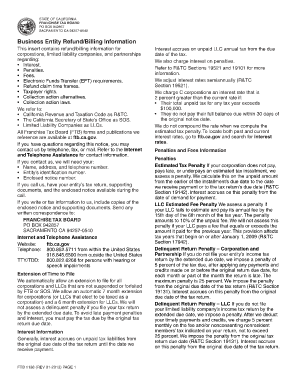

Filling out the Ftb 1138 form online can be a straightforward process if you follow the necessary steps. This guide will provide clear instructions to help users effectively complete the form for their business entity needs.

Follow the steps to fill out the Ftb 1138 form online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your entity's identification number in the designated field, ensuring that all numbers are accurate and updated.

- Fill in your entity's legal name, making sure it matches the name registered with the California Secretary of State.

- Enter the address of your business entity, including city, state, and ZIP code. Verify that all information is correct to avoid any processing issues.

- Complete the sections regarding the nature of the refund or billing by accurately describing the reason for submitting the form and providing any requested details.

- Review any calculations or fees associated with your entity, ensuring that the total amounts are correctly calculated and entered.

- Read through the completed form to verify that all fields are filled and accurate, then save your changes.

- Finally, you can choose to download, print, or share the form as necessary, ensuring that you keep a copy for your records.

Complete your Ftb 1138 form online today for a seamless filing experience.

Overview. Individual taxpayers may now be eligible for a one-time cancellation of a penalty for filing or paying their taxes late. FTB was granted the authority to provide taxpayers a one-time abatement of timeliness penalties. (Assembly Bill 194 added authority under Section 19132.5).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.