Loading

Get Form Ftb 5870a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ftb 5870a online

This guide provides clear, step-by-step instructions for filling out the Form Ftb 5870a online. Designed for users with varying levels of tax knowledge, this guide aims to simplify the process of completing this important tax form.

Follow the steps to correctly complete the Form Ftb 5870a.

- Use the ‘Get Form’ button to access the Form Ftb 5870a and open it in the online environment.

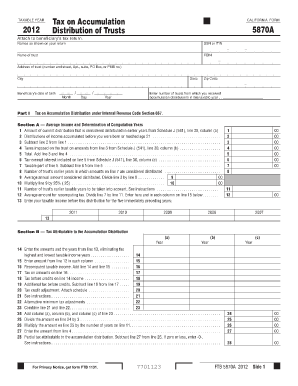

- Enter the taxable year at the top of the form. For example, use '2012' for the applicable year.

- Fill in the names as shown on your tax return, along with the corresponding Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Provide the name of the trust along with its Federal Employer Identification Number (FEIN). Specify the state where the trust is registered.

- Insert the beneficiary’s date of birth in the format of month/day/year.

- Complete the address of the trust, including the number and street, apartment, suite, or PO Box, city, and zip code.

- Indicate the number of trusts from which you received accumulation distributions during this taxable year.

- In Part I, provide details regarding the tax on accumulation distributions per the specified lines related to Income and Tax Computation.

- Continue to complete the remainder of Part I as per the instructions provided for Tax Attributable to the Accumulation Distribution.

- Once all sections are thoroughly completed, save your changes during the filling process. After finalizing your entries, download, print, or share the completed form as needed.

Complete your required forms online efficiently by following these instructions.

The IRS requires the filing of an income tax return for trusts and estates on Form 1041—formerly known as the fiduciary income tax return. This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.